Your eTIMS Solution Partner

Streamline Tax Compliance with KRA-Approved eTIMS /TIMS Solutions

Get Integrated with the KRA Approved TIMS Compliant Fiscal ETR ESD Devices

Your Apps Limited has been appointed as a Value Added Reseller for all forms of ETR currently available. Your Apps Limited is focused on providing the best KRA-approved and TIMS Compliant devices, consultation to Integrate, integrated applications & solutions to fit the demands of any Kenyan business .

Integrate to KRA Approved TIMS-compliant ETR/ESD and fiscal devices. QBO, QB, Zoho, Xero, SAP, Oracle Netsuite, Tally, Excel, JSON, Text, PDF and many more.Your Apps Limited is your go-to partner for KRA-compliant eTIMS solutions. As an authorized value-added reseller for ETIMS Solutions, we provide expert consulting and integration services to streamline your business operations.

Our eTIMS Integrated Solutions

Own a Private API

A Private API, also known as an Internal API or Enterprise API, is an Application Programming Interface that is designed and used only within a company or organization.

A private API, as opposed to a public API, is restricted to internal use by employees, partners, and other authorized entities within the organization. These APIs are typically used to facilitate communication and data exchange between different applications, systems, and services within a company.

To prevent unauthorized access, private APIs are generally not exposed to the public internet and are secured with various authentication and authorization mechanisms. They can be used for a variety of tasks, including integrating various internal systems and automating business processes.

What are the advantages of Private APIs?

Improved efficiency and productivity: By automating processes and integrating various systems and applications, private APIs enable organizations to streamline their internal operations. As a result, efficiency, productivity, and cost savings can be realized.

Increased security: Because private APIs are not accessible via the public internet, they can be protected with various authentication and authorization mechanisms. This lowers the likelihood of unauthorized access and data breaches.

Improved control: Private APIs provide organizations with greater control over their data and systems. They have control over who has access to the API, what data is accessible, and how it is used.

Your eTIMS Solution Partner

Streamline Tax Compliance with KRA-Approved eTIMS Solutions

What is eTIMS?

Developed by the Kenya Revenue Authority (KRA), eTIMS is a free software application that facilitates the management of electronic tax invoices. Users can electronically issue, transmit, and store invoices, ensuring accuracy and streamlining tax reporting.

Your Apps Limited is your trusted partner for all things eTIMS (electronic Tax Invoice Management System) in Kenya. As a certified KRA integrator and consultant, we help businesses of all sizes simplify their tax compliance processes.

Why Choose eTims

eTIMS is completely free to use, eliminating the need for additional software expenses.

Automate invoice issuance and transmission, saving valuable time and resources.

eTIMS integrates seamlessly with KRA systems, making tax return filing quick and effortless.

Maintain a centralized database of all issued invoices for easy access and audits.

Gain better control over your stock with real-time invoice data.

Eliminate manual invoice entry mistakes, ensuring data accuracy and reducing penalties.

Key Features of Our eTIMS Integration

Automated Invoicing

Streamline your invoicing process with automatic submission to KRA’s systems.

Customizable Solutions

Tailored to your business’s invoicing needs, whether you’re using ERP solutions or custom-built software.

Real-Time Data Syncing

Stay updated with real-time tracking of all your tax invoice submissions.

Enhanced Security

Safeguard your business data with secure and encrypted connections that meet KRA’s eTIMS security standards

How Your Apps Limited Can Help

- Seamless Integration: Integrate eTIMS with your existing accounting software like QuickBooks or NetSuite for a unified management experience.

- DATECS API and Tremol API Integration: Leverage our expertise to flawlessly connect your eTIMS with these APIs.

- Control Unit Integration: We assist with acquiring and integrating KRA-approved eTIMS control units for efficient invoice issuance.

- Expert Consulting and Support: Our team of eTIMS specialists provides expert advice and ongoing support to ensure you utilize the platform to its full potential.

How Our eTIMS Integration Works

At Your Apps Limited, we integrate eTIMS into your current invoicing or ERP systems. This allows you to:

Generate KRA-Compliant Tax Invoices: All invoices are automatically sent to KRA’s iTax System, ensuring that you remain compliant.

Monitor Real-Time Reporting: You can track submitted invoices in real-time, giving you better control over your tax records.

Seamless Integration: We ensure that eTIMS integrates smoothly with your existing systems, so there is no disruption in your workflow

KRA APPROVED TIMS DEVICES

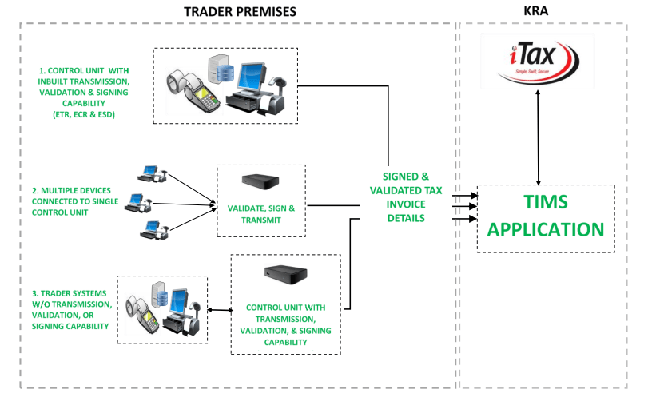

The country’s current ETR Structure is strengthened by the new TIMS compliant ETR Machine.

It is preloaded with a number of features that will simplify revenue submission by businesses and, in turn, simplify the government’s revenue collection process. This will be accomplished in a number of ways, including:

- The traders' ERP, Point-of-Sale system, or billing management systems will be integrated with TIMS-compliant devices.

- Real-time or near real-time standardization and authentication of tax invoices sent out by VAT traders.

- Seamless integration with iTax.

- Verification of tax invoice legitimacy through the Tax Invoice Checker on the iTax portal or mobile app, accessible to officers, traders, and the general public.

What is TIMS

The Tax Invoice Management System (TIMS) replaces the present Electronic Tax Register (ETR) system, which was implemented in 2005. It will improve electronic tax invoice administration by standardising, validating, and transmitting invoices to KRA in real-time or near real-time.

What are the key features the public should look for in a tax invoice?

The following are the key features of a valid invoice:

- PIN and Name of the Trader: 123456789 - John Doe Enterprises

- Time and Date of the Invoice: 2025-06-22 14:30

- Invoice Serial Number: INV-2025-0001

- Buyer PIN (Optional): 987654321

- Total Gross Amount: KES 10,000.00

- Total Tax Amount: KES 1,600.00

- Tax Rate: 16%

- Total Net Amount: KES 8,400.00

- Unique Register Identifier: URN-123456

- Digital Signature (QR Code): /li>

Taking into consideration the transition period, the new features e.g. the QR Code will only be visible once a VAT-registered trader is using the Tax Invoice Management System.

NB: The QR Code will only give a result where the invoice has been transmitted to KRA.Contact

TIMS Integrated Oracle NetSuite Addon

Your Apps Limited has been appointed as a Value Added Reseller to provide training in all forms of ETR currently available. Your Apps Limited has focused on providing the best KRA certified device to fit the demands of any Kenyan business.

Type A Desktop ETR

Tremol M23

Desktop ETR with improved design and features, and a simple and intuitive user interface. Barcode readers, cash drawers and electronic scales all have multiple interfaces. You can connect multiple devices over your local network.Get a Quotation

Type A Desktop ETR

Datecs WP25

WP25 represents the classic concept of electronic cash registers. Built around a powerful ARM processor, it provides customers with a variety of features and reports. Suitable for medium-sized shops, restaurants, etc.

Type A Mobile ETR

Tremol S25

Tremol has developed the smallest ETR with GSM, WiFi, and Bluetooth (optional). It’s ideal for vehicle sales and delivery. Tremol S25 has the advantage of built-in batteries and charging through a regular USB SV converter (port).Get a Quotation

Type B | C Control Unit

Tremol G03

Available in two types: Type B for retail POS application users and Type C for ERP and accounting applications. It can work on multiple operating platforms and has an extensive API library for integration with different programming languages.

Type B Fiscal Printer

Datecs FP700

A heavy-duty fiscal printer with an integrated Type Control Unit for enterprise use. RS 232, USB, and Ethernet connectivity are available to handle large retail points of sale and services. Upgrade your current devices or replace them for a lower cost.Get a Quotation

FAQ

According to the law, traders and businesses must register for value added tax if they make at least KSH 5 million annually or anticipate doing so (VAT).

- Each VAT registered trader will be required to obtain this KRA approved TIMS device (also known as a Control Unit) as an independent or integrated component in order to enable the seamless transmission of invoice data to TIMS.

- One of the top TIMS integration solution providers, Your Apps Ltd, specializes in KRA’s TIMS Device integrations and offers a variety of ready-to-use TIMS integrated Add-ons.

- Your Apps Ltd can help you integrate your ERP, Point of Sales (POS), accounting and other applications to the KRA’s TIMS devices.

- Your Apps Ltd is an approved Value Added Reseller for various KRA approved TIMS devices in the market.

The requirements are applicable to all VAT-registered taxpayers.

The prices vary from supplier to supplier, there are also options for upgrades available in the market. The new generation machines or ETR can cost anywhere between Kenya shilling 40,000 to 100,000 and above.

Depending on the usage you can opt between Four options available in the market.

- Type A or ETR – Suitable for small businesses doing manual billing with no software integration.

- Mobile ETR – Compact manual ETR machine with Wifi, LAN, GPRS. Ideal for users with fewer bills daily.

- Desktop ETR – Robust manual ETR machine with Wifi, LAN, GPRS. Has a larger keypad for faster input.

- Type B Fiscal Device – For retailers using POS systems for quick cash billing.

- Fiscal Printer – Prints receipts directly to the KRA-approved TIMS fiscal device with in-built printer.

- Mobile Printer – Portable printer with Wifi and GPRS, can be used on the go or worn on a belt.

- Control Unit – Connects multiple cashier points, ideal for retail outlets. Can be networked.

- Type C – For traders using ERP or accounting systems. Supports network and multiple connections. Easily integrated.

- Type D – Combines features of Type A, B, and C. Configured as per user needs. Suitable for all business types.

Generally, the hospitality industry has a 2% Tourism levy and other service charges, some of the ETR in the market does allow you to enter other charges or levies to be included in the price, but the same is not transmitted to TIMS. For purpose of transmitting data to TIMS, other charges or levies will be not included in details that are transmitted for accounting of VAT.

when integrating your systems with Kra-approved TIMS devices, it is advised that your unit price shall be reduced by the value of the discount or rebate allowed. All discounts or rebates provided should be accounted for as per Section 13(3) of the VAT Act 2013.

No, you cannot issue a bulk credit note, Section 16 (6) of the VAT Act 2013 indicates every credit note requires users to refer to the invoice on which the supply was done.

Yes, you can issue invoices in Foreign Currency, but according to Section 23 of the Tax Procedures Act, the unit of currency in books of account, tax returns, and tax invoices must be in Kenya shillings. Taxpayers are recommended to change their foreign cash into Kenyan shilling equivalents using the day’s CBK mean rate. The foreign currency values may show on the invoice, but for tax reasons, the Kenya shilling values will be used.

The agent’s commission or fees for services given are taxable. However, any expenses paid on the client’s behalf are exempt from VAT. The specifics of the payout may appear on the invoice sent by the agent to their customer for services delivered. Refer to the 11th February 2021 public announcement https://www.kra.go.ke/news-center/public-notices/1113-deduction-of-input-vat-by-trade-agents