YAL UPDATES

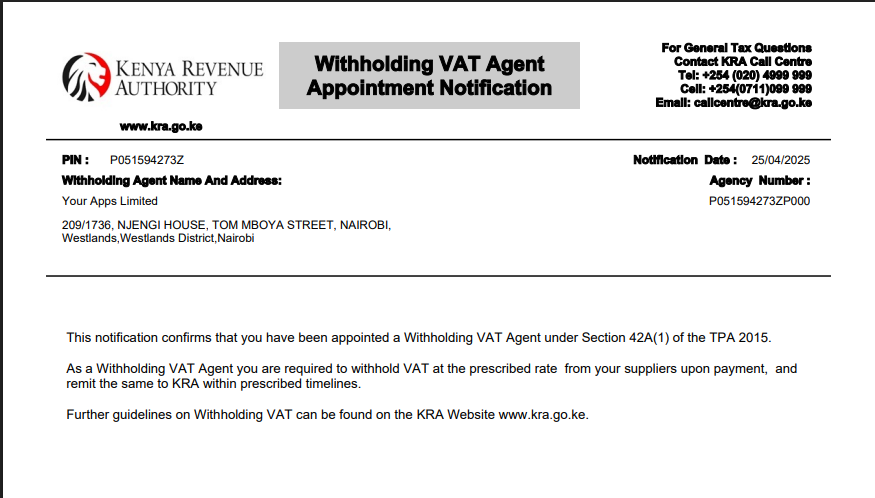

YAL appointed as a withholding VAT agent by the Kenya Revenue Authority (KRA), effective 25th April 2025.

We are pleased to inform you that YAL has been officially appointed as a Withholding VAT Agent by the Kenya Revenue Authority (KRA), effective 25th April 2025. As part of this new responsibility, we will be required to withhold VAT at the rate of 2% on all applicable supplier invoices, in line with Section 42A(1) of the Tax Procedures Act, 2016. The withheld VAT will be remitted directly to KRA within the prescribed timelines(5 days). This change will have implications on our payment processes.We encourage everyone to familiarize themselves with and ensure full compliance with the new requirements.